The behaviour of prices after periods of high inflation can vary, but generally, prices of goods and services do not decrease significantly, keeping the cost of living high.

Once prices have increased due to inflation, they tend to remain higher.

This phenomenon is often referred to as “price stickiness.”

Businesses may be reluctant to reduce prices even if inflation rates decrease due to factors like menu costs (the cost of changing prices) and the desire to maintain profit margins.

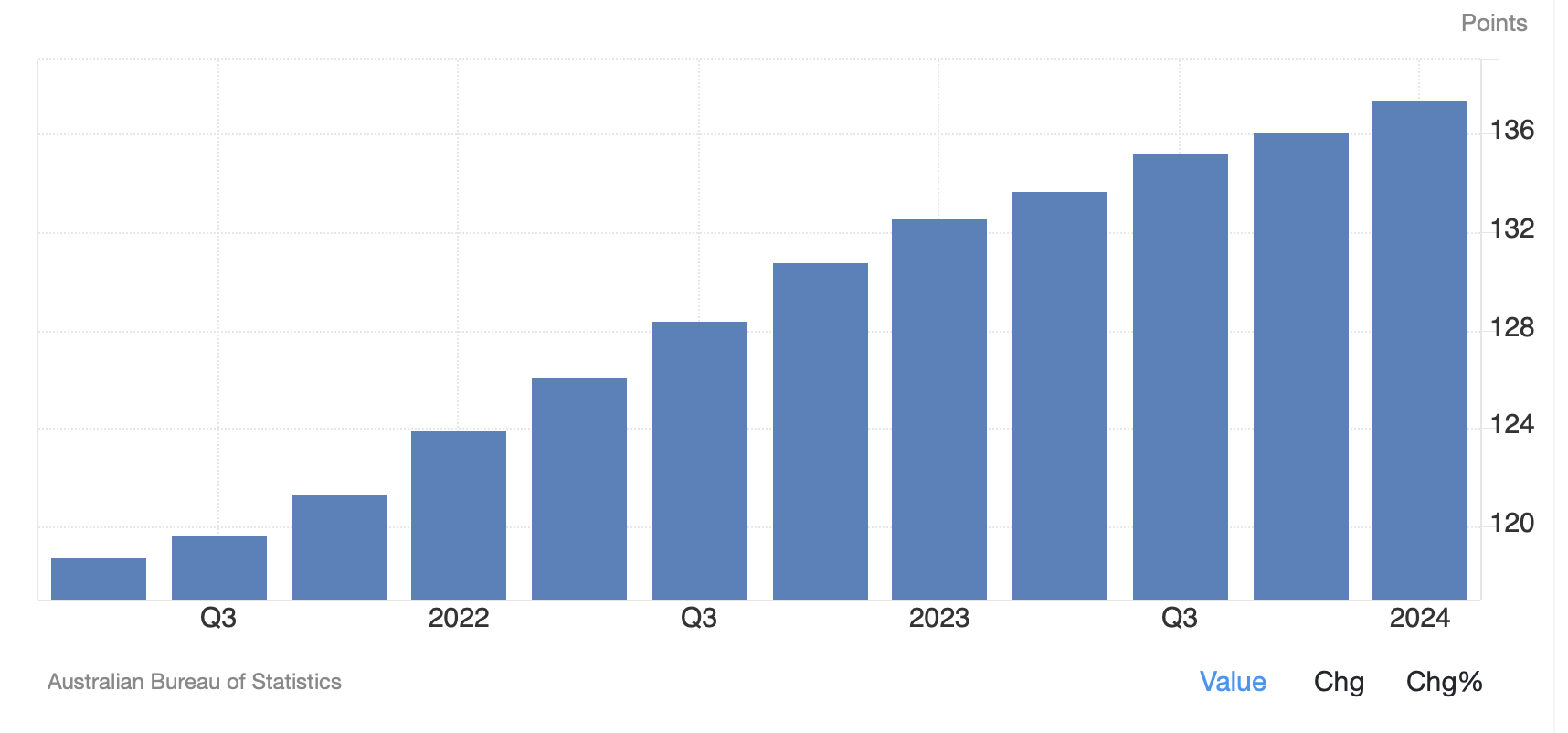

The measure of inflation in Australia is the Consumer Price Index (CPI). In 2021 (Q2), the CPI was at 118.8 points; now, in 2024 (Q1), it is 137.4 points.

That is an increase of 15.7%!

In some sectors, this increase is double. The graph below highlights the impact of inflation on prices.

So, what can you do about it?

Here are our tips to help you reduce the cost of living.

Budgeting and Financial Planning

To effectively manage and reduce your cost of living, start by creating a detailed budget.

Track all sources of income and categorize your expenses into groups like housing, food, and transportation.

Use budgeting apps or spreadsheets to monitor your spending and identify where you can cut costs.

An emergency fund can also be built by saving 3-6 months’ living expenses to cover unexpected costs.

It’s also important to set short- and long-term financial goals, such as saving for a down payment on a home or paying off debt.

Reduce Housing Costs

To reduce housing costs, consider downsizing by moving to a smaller, more affordable home or apartment to lower your rent or mortgage payments.

Relocating to an area with a lower cost of living can also provide significant savings.

Additionally, renting a spare room or opting for co-living arrangements can help share and reduce housing expenses.

Negotiating with your landlord for a lower rent or securing a longer lease term for a discount can further decrease your housing costs.

Transportation Expenses

To save on transportation costs, consider using public transportation such as buses, trains, or subways instead of owning a car.

Carpooling with colleagues or friends can help split fuel and maintenance expenses. For short distances, walking or biking can be cost-effective alternatives.

Keeping your vehicle well-maintained can also prevent costly repairs and improve fuel efficiency.

Save on Food Costs

Plan weekly meals to avoid impulse buying and reduce food waste to save on food and grocery costs.

Purchase non-perishable items in bulk to save money and take advantage of coupons, loyalty programs, and sales.

Additionally, cook meals at home instead of dining out or ordering takeout.

Lower Utility and Energy Costs

To reduce utility and energy costs, use energy-efficient appliances and light bulbs, and insulate your home to lower heating and cooling expenses.

Regularly compare utility providers to ensure you’re getting the best rates.

Reduce usage by turning off lights, unplugging electronics when not in use, and using programmable thermostats to manage heating and cooling efficiently.

Manage Healthcare Expenses

To avoid costly medical treatments, focus on preventive health measures, such as regular check-ups and maintaining a healthy lifestyle.

Ensure you have adequate health insurance coverage to minimize out-of-pocket expenses.

Shop around and compare prices for medications and medical procedures.

Entertainment Savings

Participate in free or low-cost activities, such as community events, parks, and library programs.

Review subscriptions: cancel or downgrade unnecessary subscription services.

DIY entertainment, opt for home-based entertainment, such as movie nights or game nights.

Debt Management

Consolidate debt: Consider consolidating high-interest debts into a single loan with a lower interest rate.

Pay off high-interest debt first: Prioritize paying off high-interest debts to reduce overall financial burden.

Negotiate with creditors: Contact creditors to negotiate lower interest rates or payment plans.

By implementing these strategies, you can effectively manage and reduce your cost of living, improving your financial stability and quality of life.