Mortgage rates are a pivotal factor in the housing market and personal finance, acting as a significant influence on homeowners’ financial stability and planning. In this article Mortgage Rates: An Each-Way Bet, we look at the current forecasts and implications.

The Consumer Price Index (CPI), the measure for inflation, is a key determinant for interest rates. With the release of the June quarter 2024 CPI days away, the Big 4 Banks currently predict we are already at the peak, 4.35%.

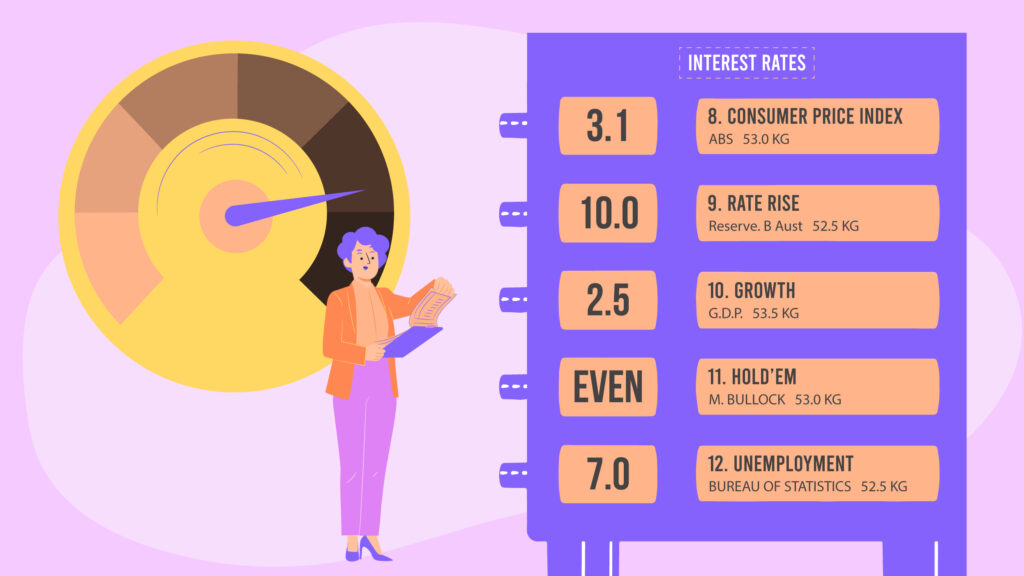

Over the twelve months to the March 2024 quarter, the CPI rose to 3.6% per annum. This writer believes, if the CPI increases to 4.0% per annum, the RBA will raise rates, anything below, rates will remain on hold for the time being. The RBA next interest rate decision is on 6 August 2024.

The fluctuations in interest rates can cause both opportunities and challenges, making them a crucial aspect to understand for anyone involved in real estate or considering a mortgage.

Understanding Mortgage Rates in Australia

As of 2024, the Australian mortgage market has seen considerable shifts over the past 2 years. Following a period of historically low interest rates, the Reserve Bank of Australia (RBA), in May 2022, initiated a series of rate hikes to combat inflation.

This led to an increase in mortgage rates, affecting new borrowers, those with variable rate loans and depending on the term, fixed rate borrowers.

Current Mortgage Rates

The current average variable mortgage rate in Australia is approximately 6.27%, for owner occupiers as of May 2024 according to the RBA. These rates can vary significantly depending on the lender, loan amount, and borrower’s credit profile.

Forecasts and Predictions

ANZ predicts that the current level of 4.35% will be the cash rate’s peak, with the first cuts to start around February of 2025, and rates dropping to a level of around 3.60% by the end of 2025.

Commonwealth Bank predicts that the current level of 4.35% will be the cash rate’s peak, and that the first cut is likely to occur around November, with rates eventually dropping to around 3.10% by the end of 2025.

NAB economists predict that the current level of 4.35% is the cash rate’s peak, with the first cuts to occur around May of 2025, and rates reducing to 3.60% by the end of 2025.

Westpac predicts that the current level of 4.35% will be the peak, and that we might expect the first rate cuts to occur around November, with the cash rate eventually settling at 3.10% by the end of 2025.

If, however inflation continues to increase, rates are bound to rise. Let’s look at the implications.

Impact of Mortgage Rate Increases

Financial Planning

Increased Monthly Payments: Higher mortgage rates translate to increased monthly repayments for borrowers with variable rate loans. This can strain household budgets, necessitating a revaluation of financial plans.

Refinancing Challenges: Borrowers looking to refinance their loans may find fewer attractive offers, as higher rates reduce the benefits of switching to a new mortgage.

Stress Levels

Financial Stress: The unpredictability of mortgage rates can lead to heightened financial anxiety. Homeowners may worry about their ability to meet increased payments and the potential for further rate hikes.

Impact on Savings: Higher mortgage payments can reduce disposable income, affecting savings and investments. This can lead to long-term financial stress as individuals struggle to balance immediate needs with future financial security.

Strategies to Mitigate the Impact

Fixed-Rate Mortgages: Locking in a fixed rate can provide certainty over payment amounts, protecting against future rate increases.

Budget Adjustments: Revising budgets to accommodate higher mortgage payments can help manage cash flow and reduce financial stress.

Emergency Funds: Building an emergency fund can offer a safety net for unexpected financial pressures, including rising mortgage costs.

Financial Counselling: Seeking advice from financial advisors can provide strategies to manage mortgage payments and overall financial health.

The Big 4 Banks however are forecasting rates to start falling from late 2024, and throughout 2025 providing much needed relief to mortgage holders.

Mortgage rates play a crucial role in the financial well-being of homeowners and potential buyers.

Understanding the current landscape, forecasts, and the impact of rate fluctuations is essential for effective financial planning.