Managing the Cost of Living is the No. 1 concern for millions of Australians in 2024. In this article we look at How to Lower Your Cost of Living.

Latest Statistics

For the 27th consecutive month, Cost of Living remains the top concern for Australians, with 65% of people citing it as their biggest concern according to the latest to Issues Monitor report.

Create a Budget and Stick to It

Budgeting is the foundation of financial management. By tracking your income and expenses, you can identify areas where you can cut costs. Use budgeting apps or spreadsheets to monitor your spending and set realistic financial goals.

Reduce Utility Bills

Energy costs can be a significant part of your monthly expenses. Here are some tips to lower your utility bills:

Get a Better Deal: The Australian Competition and Consumer Commission (ACCC) provides useful information on actions to take to find a better deal.

Switch to Energy-Efficient Appliances: Invest in energy-efficient appliances and LED lighting to reduce electricity consumption.

Use Off-Peak Tariffs: Take advantage of off-peak electricity tariffs by running high-energy appliances, like washing machines and dishwashers, during off-peak hours.

Insulate Your Home: Proper insulation can help maintain the temperature of your home, reducing the need for heating and cooling.

Save on Groceries

Food expenses are another major component of the cost of living. Here are some strategies to save on groceries:

Plan Your Meals: Planning meals in advance can help you avoid impulse purchases and reduce food waste.

Buy in Bulk: Purchase non-perishable items in bulk to take advantage of discounts.

Shop Smart: Look for weekly specials, use discount vouchers, and compare prices across different supermarkets.

Cut Transportation Costs

Transportation can also be a significant expense. Consider the following tips to save on transportation:

Use Public Transport: Public transportation is often cheaper than driving, especially when you consider the costs of fuel, parking, and maintenance.

Carpool: Sharing rides with colleagues or friends can help reduce fuel costs.

Consider a Smaller Car or Bike: Smaller cars and bikes are more fuel-efficient and cheaper to maintain.

Reduce Housing Costs

Housing is usually the largest expense for most households. Here are some ways to cut housing costs:

Downsize: If possible, consider moving to a smaller home or a more affordable area.

Rent Out Extra Space: If you have extra rooms, consider renting them out to generate additional income.

Refinance Your Mortgage: Look for better mortgage deals to lower your interest rates and monthly payments.

Limit Discretionary Spending

Discretionary spending includes non-essential expenses like dining out, entertainment, and shopping. Here’s how to manage it:

Eat Out Less: Cooking at home is usually cheaper and healthier than eating out.

Find Free Entertainment: Look for free or low-cost entertainment options like local parks, community events, or library programs.

Set Limits: Allocate a specific amount for discretionary spending each month and stick to it.

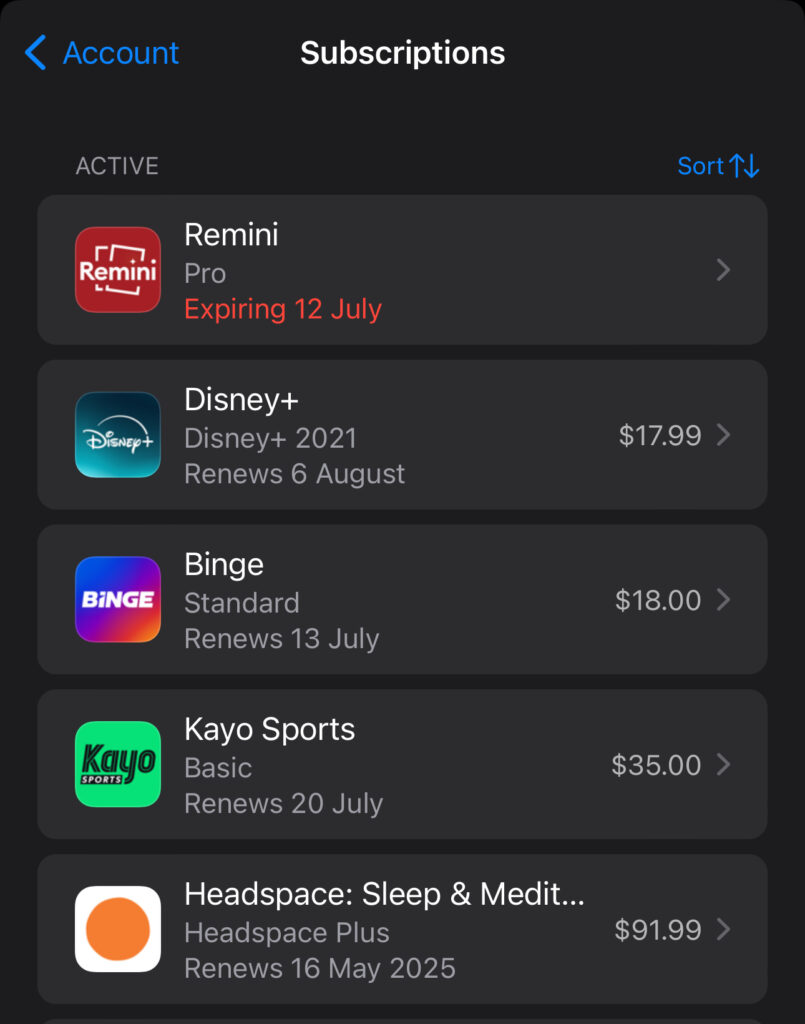

Review and Cancel Unused Subscriptions

Subscriptions can add up over time. Regularly review your subscriptions and cancel any that you don’t use or need, such as streaming services, gym memberships, or magazine subscriptions.

Use Discounts and Cashback Offers

Take advantage of discounts, cashback offers, and loyalty programs to save money. Many credit cards and apps offer cashback on purchases, which can add up over time.

Australia’s No. 1 Cashback website is cashrewards.

DIY When Possible

Doing things yourself can save a lot of money. Whether it’s home repairs, gardening, or minor car maintenance, there are plenty of tutorials online to guide you.

Improve Financial Literacy

Invest time in improving your financial literacy. Understanding personal finance can help you make informed decisions and find more ways to save money.

Consider reading books, attending workshops, or taking online courses on financial management.

Start with small changes and gradually adopt more cost-saving measures to see a significant impact on your overall financial health.