Blogs

- All

- Articles

- Bitesize

- Budgeting

- Cost of living

- Credit Cards

- Disorganised Finances

- Finance

- Financial Freedom

- Financial literacy

- Financial Stress

- Financial Wellbeing

- Happiness

- Health & Wellbeing

- Impulse Spending

- Interview

- Loss of employment

- Mindfulness

- Money and Children

- Money and Relationships

- Money beliefs

- Money in Relationships

- Mortgage

- Paying Bills | Financial Mindfulness

- Retirement

- Spending

- Under-earning

- Unexpected Expenses

- Women and money

- Work

In a sea of couple conflict, find stability with Financial Mindfulness. David and Lisa were filled with love and optimism when they …

Find your pulse, stop impulse buying Who hasn’t indulged in a little retail therapy from time to time, especially after a shocking …

Single Women Leading Men in US Home Ownership. The latest research into women’s struggles with money, Mary Pilon of Bloomberg notes, can …

Employees want mental health at work taken seriously. Australian employers don’t understand their employees’ major life concerns, according to a study of …

Can’t afford a comfortable retirement. A huge 47 per cent of Australians between 26 and 64 – 6.1 million people – are …

Financial wellness eluding Americans: could mindfulness help. Financial stress is rife in the western world, perhaps no more so anywhere than the …

Using mindfulness practice helps reduce financial stress and strain. The word ‘mindfulness’ seems to be everywhere these days.

The cost of divorce: unhealthy spending, retirement ‘bleak’, huge benefit and court costs.

Proven: the power of mindfulness over bad financial decisions. If you’ve ever persisted with a disastrous job or relationship or PhD in …

When mindfulness might not work. Unless you’ve been living under a rock you will know the word ‘mindfulness’ has quite a buzz …

The Power of apps for improving mental health. The idea that an app could replace face-to-face doctor’s appointments or be recommended over …

Good mental health a much bigger factor in happiness than money. Earlier this week Norway was named the happiest nation on earth, …

How mindfulness helped a bunch of chronically anxious worriers. Time magazine recently ran an article with the headline ‘how mindfulness helps you …

Why isn’t mindfulness working for me. Mindfulness, in theory, sounds great. The deal seems to be roughly this: if I sit still …

Send yourself a valuable gift: get mindful. Why do we spend money to feel good now, even if it’s clearly going to have …

Mindfulness could complement CBT interventions for depression. Anyone who has been truly depressed understands how vast the difference is between knowing it’s …

Employees want help with their financial stress. Does it strike you as strange that the biggest stressor we face isn’t talked about …

The staggering costs of personal financial stress at work. For a while we’ve known that financial stress has an impact on our …

Mindfulness practice reduces time off work for anxiety sufferers. Working with someone who is extremely anxious isn’t always fun, but it’s worth …

Financial stress: 9 out of 10 suffering. We asked you, our Financial Mindfulness Facebook family – across Australia, the United States and …

Financial stress is widespread for Australians. Financial Mindfulness released its latest Financial Stress Survey and the results showed just how much damage …

Financial stress devastating Australians, close to 1 in 3 Australians suffer from significant financial stress, which has for the first time been …

Financial stress behind mental health insurance claim spikes. New research reveals that financial stress is a hidden mental health trigger for Australians …

Shop till you Drop. We are still on holidays, right? Well the majority of us are enjoying the holidays somewhere with our …

Power of Mindfulness over bad financial decision making. If you’ve ever persisted with a dead-end job or loveless relationship or a university …

Stressed about your finances or your mortgage. Financial Mindfulness was covered in Yahoo Finance If you’re experiencing financial stress, you’re dealing with …

Perfect storm of credit card debt brewing for Australians during COVID-19. Rapidly falling incomes, a move to card-only payments and a complete …

Credit card giant Mastercard reported a major shift in consumer behaviour that has seen 44% of Aussies decrease their use of cash …

Australians distressed and acting aggressively to others. These are the findings from the latest Financial Mindfulness Financial Stress Index (FSI) report which …

Financial stress is widespread Money worries are common. They existed before COVID-19 and now with changes in our employment and society, financial …

Financial mindfulness. The term mindfulness is used a lot in relation to meditation and psychological therapies to describe being aware and paying …

Understanding the Sunk-Cost Fallacy If you’ve ever persisted with a dead-end job, loveless relationship, or regrettable university degree, hoping it will somehow …

The real cost of gift-giving: Financial stress – part 1. The tinsel and decorations are still under the stairs, but now is …

The real costs of gift-giving: Financial stress – part 2. Who wants to buy something special for their partner, relative, friend or …

The real cost of gift-giving: financial stress – part 3. In ancient history giving gifts began as part of the ritual of …

Want to avoid financial stress: ask yourself these questions. There’s never been so many options for accessing cash quickly as there are …

Happy holidays: stress less with mindfulness this Christmas. Christmas and the holidays are mostly feelgood times. At least the ideas behind them …

How to stop spending too much at Christmas. Christmas is by far the busiest time of the year for shopping and many …

Six great New Year’s Resolutions to improve your finances in 2021. These days we know there is a correlation between our financial …

Call it what you will, peace of mind, inner peace, sanity, contentment, serenity – that feeling of freedom from when your brain …

Why women suffer more from financial stress. Recent studies have found women feeling considerably more financially stressed than men – but why? …

Financial stress and under-earning. When people think about answers to financial stress a lot of energy and attention is paid to our spending. …

Using Mindfulness practice to help reduce financial stress. Mindfulness has been a big buzzword for several years. The cabin-fever worry of the …

Financial stress a perennial reason couples split. It’s February already and in a lot of relationships that means money worries will be …

Money doesn’t make you happy, but bad debt makes you sick. You can’t buy happiness, goes the old saying. We also know …

Mindfulness to remain a key part of what it means to be human in the future. While we look in awe at …

Mindfulness can help you get in control of your spending. Why do we spend money to feel good now, even if it’s …

Graduates arrive in their careers with financial stress. Graduating from University is an exciting and rewarding experience. The prospect of being in …

Financial Mindfulness exclusive interview with Dr Ellen Langer – Part 1. Financial Mindfulness had the good fortune in March 2021 to secure …

Financial Mindfulness exclusive interview with Dr Ellen Langer – Part 2. We continue with our exclusive interview with the world-renowned Professor Ellen …

Find stability with Financial Mindfulness. With a horrible year in 2020, routines have returned back to normal but 2021 hasn’t started well. …

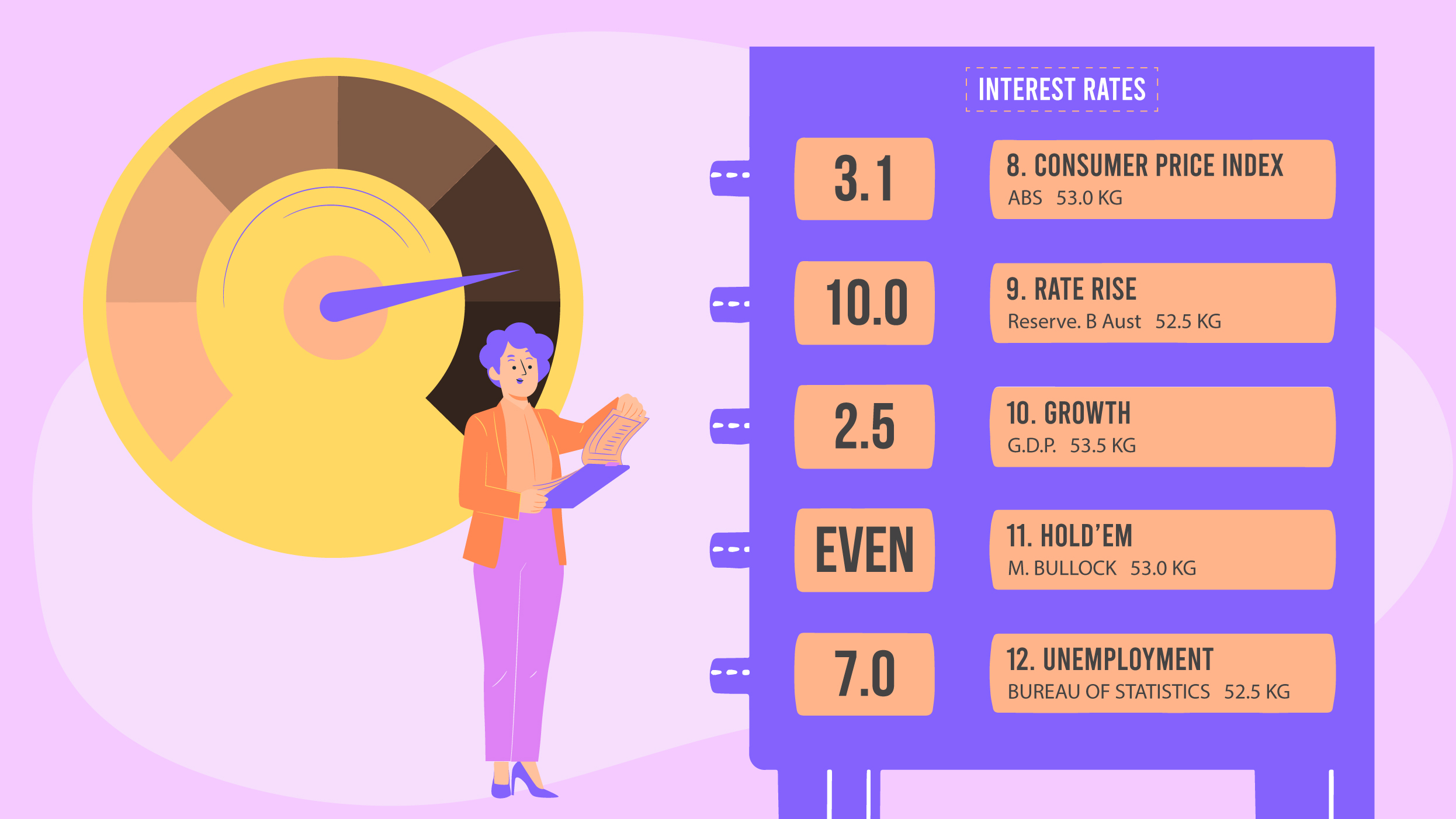

March 2021 Financial Stress Index (FSI) report Number of Australians ‘thriving’ bounces back dramatically as Covid nears end, but worst affected still suffering. …

Staggering number of Australians with less than $2000 in the bank. Financial Mindfulness was interviewed by the Daily Mail on the latest …

Australians rebounding from pandemic Financial Mindfulness was reported in Money Management on its latest financial stress survey. Australians assessed as “thriving” financially …

Key insights from the FSI report. A significant focus of Financial Mindfulness is the tracking and reporting of our Financial Stress Index …

The Australian dream holds big financial risks. It’s said that the American dream is upward mobility – the ultimate example being to …

Proving the business case for financial wellness programs. Financial wellness has been a buzz phrase in the workplace for a few years …

Why isn’t mindfulness working for me. Mindfulness, in theory, sounds great. The deal seems to be roughly this: if I sit still …

The cost of divorce and its impact on families. We know that divorce – the unsettling reality for one in three marriages …

New clinical help on the horizon for shopalcoholics. We all instinctively know that compulsive, mindless spending can be a problem. We see …

Why our financial literacy matters. While knowledge is power, the lack of knowledge can leave us vulnerable in many areas of life. …

Ten steps to increase your financial literacy. The feeling of fear and anxiety of not knowing your subject matter strikes most of …

Why do women under-earn. Research constantly proves the point that women earn less than men. In Australia, legislation exists to promote and …

Sunk cost fallacy and mindless behaviour. If you’ve ever persisted with a dead-end job, a loveless relationship or a university degree you …

Mythbusting our beliefs about financial stress. Financial Mindfulness interviewed a dozen people in Hyde Park Sydney while gathering footage for a marketing …

What about the financial mindfulness part. One crucial component of the Financial Mindfulness program is the practice of mindfulness.

Why do a personal budget. We have started a new financial year. Like in previous financial years, new rules come into effect.

How to budget successfully. Last week, we established that budgeting isn’t easy, so you need to understand why it’s a behaviour that …

How to maintain a budget. Setting up a budget is a great step toward improving your relationship with money and, ultimately, your …

How can we reduce mortgage stress. Despite sustained, record low interest rates, repaying a mortgage remains one of the most significant financial …

Lowering financial stress and stress in general. Financial stress is debilitating; it can add a layer of unwelcome, even toxic, distraction to …

Buy now pay later. Popular new payment services like Afterpay, Openpay, Zip Pay and soon, Paypal’s ‘Pay in 4’ – collectively known …

How to reduce the shock of unexpected expenses Unexpected events are by definition surprising and can cause anxious feelings in most of …

What to do if lockdown has caused me financial stress. Right now, millions of Australians are under public health orders to stay …

Money and relationships. Many elements can lead to relationship tensions and even breakdown. One of the most difficult to change can be …

Disorganised finances. A persistent, nagging fear of money is all too real for many people. The medical word for it is Chrematophobia, …

Managing financial stress – Decision making, literacy, learning new skills. In the first part of our financial stress webinar covering managing financial …

Managing financial stress and mindfulness. In the second part of our financial stress webinar covering managing financial stress, we look at goals, …

Loss of employment. Losing a job is one of the most stressful things that can happen to a person.

Under-earning and financial stress. ‘Under-earning’ – that some people earn less than what they’d like to or even deserve to earn – …

What you need to know to be a mindful shopper. The pandemic has placed enormous pressure on the global supply chain, which …

Learn quick and easy ways of how to reduce debt. Finance is a large part of a person’s life. Who doesn’t require …

Easy ways to know about Financial Stress and Mental Health are right here.

How to Reduce Financial Stress in simple ways. Every human being aspires to gain financial independence. In times such as these, facing …

Get to know simple ways of how to manage credit cards. Who doesn’t like spending money on things that they want to …

Paying bills Paying bills and staying ahead. Back in 2017 when the Financial Mindfulness journey began we asked our growing army of …

Pandemic put’s young families under huge financial stress. Even if you don’t have children, you may be aware through your friendships and …

Don’t blow your savings. The endless restrictions and lockdowns Australians experienced during the pandemic did more to us than make us want …

Setting goals. Budgeting is an essential part of achieving any personal financial goal, however, you will find it challenging to achieve your …

Ways to Budget There are many ways to budget; they range from simple to complex, depending on your needs.

Benefits of Budgeting. Keeping a budget can allow you to:

Culling Costs. If you’re finding it hard to make ends meet, or you do not have a surplus cashflow, i.e., you have …

Mindfulness for Budgeting. Does the thought of a budget make you feel uncomfortable, stressed or restricted?

Review your Spending Establish which expenses are not necessary. For example, ask yourself ‘if need be, where could I reduce or cut …

Behind in your bills. Being behind in payments can be very stressful and may feel overwhelming.

Mindful spending. Being a mindful spender is not about restricting your spending, but being conscious of how, when and where you spend …

Planning ahead with money Many of our unexpected expenses aren’t so much unexpected as they are unplanned. When you become aware of …

Mindfulness to manage unexpected expenses Unexpected expenses can catch us by surprise and create feelings of anxiety or stress.

Introduction to Mindfulness At its core, mindfulness meditation is a practice of cultivating present-moment awareness and non-judgmental attention to our thoughts, feelings, …

Money, relationships and stress. Whether we like it or not we live in a world that runs on money, especially in OECD …

Our Guide to last minute Christmas shopping Because Christmas is a time of family and giving that means it’s a time of …

New Year’s Resolutions – part 1

New Year’s Resolutions – part 2

Taking stock of 2021 to plan for 2022. As our employers and our own small businesses start to focus on the coming …

Using mindfulness to support goal-setting. Living mindfully means living in the present moment, that’s an accepted and true definition.

Enjoying the New Year in Australia The beginning of the New Year in Australia is a delightful period, however, as February approaches, …

The warning signs of compulsive shopping. The humdrum feelings we get from returning to work after a holiday, that ‘back to reality …

Revisiting your 2022 goals. Most of us recognise the importance of setting goals, but what happens when we break promises to ourselves …

How a no-spend challenge can help your financial goals. What if there was a simple way to change our damaging spending patterns?

How renters can avoid fear of financial failure. Whether or not it’s always true, renting your home rather than owning it is …

What renters can practically do to improve their finances. In the first part of this series, we examined the mindset problem that …

Applying mindfulness to disorganised finances. There’s a tough but essential reality to face with your personal finances if you ever want to …

Practical tips to organise your personal finances. In part 1 of this series on disorganised finances we looked at the importance of …

Keeping up with the Joneses. In a recent article on how renters can avoid fear of financial failure we referred to the …

Can you actually afford to buy. There is so much pressure to buy a home to enter the property market these days …

Uni students become more debt laden. University students will feel the pinch even more as the indexation rate applied to HECS–HELP loans …

Top five reasons people get into mortgage stress. Mortgage stress is never far from the news in Australia, with years of historically …

Dealing with financial stress from increased cost of living. Australia is in the grips of cost-of-living crisis which poses a threat to …

The business case for financial wellness programs. Financial wellness has been a buzzphrase in the workplace for many years, with good reason.

Under-earning and financial stress At a time when basic living costs are dramatically rising, with inflation set to hit 7 per cent …

Why women suffer more financial stress. Recent studies have found women feeling considerably more financially stressed than men – but why?

Women and Super The disparity between men and women with employment incomes is well known and persistent. This pay gender gap causes …

Money and infidelity main reasons couples divorce. We know that divorce – the unsettling reality for one in three marriages – usually …

In the first part of our financial stress webinar series, Dr Nicola Gates provides a detailed look at financial stress.

Measuring financial stress. In the second part of our financial stress webinar series, Dr Nicola Gates provides a detailed look at measuring …

Avoid impulse spending – Black Friday and Cyber Monday sales. Black Friday and Cyber Monday sales are upon us, with a marketing …

Last minute Christmas shopping guide Because Christmas is a time of family and giving, that means it’s a time of decisions.

If you made a New Year’s Resolution, was it geared towards your financial wellness? If it wasn’t, or you didn’t make one …

Money and relationships. Many elements can lead to relationship tensions and even breakdown. One of the most difficult to change can be …

The shock of unexpected expenses can cause anxious feelings in most of us. Where it’s a positive surprise that speaks for itself, …

Achieving financial freedom is a deeply personal journey that varies greatly depending on individual circumstances, goals, and aspirations.

Women and financial stress. Financial stress is a universal challenge that knows no boundaries, affecting individuals and households across the globe, in …

In a world often measured by material wealth and economic prosperity, the pursuit of happiness stands as an enduring quest, transcending boundaries …

The desire to buy a home is deeply ingrained in the Australian psyche and culture. It stems from various factors that reflect …

Retirement marks a significant milestone in life’s journey—a time to reap the rewards of a lifetime of work, pursue passions, and relax …

One of our most important responsibilities as parents is teaching our children the skills they need to thrive; financial literacy is no …

Starting a family is a significant milestone that brings joy, excitement, and new responsibilities.

Money, it’s a topic that permeates nearly every aspect of our lives, and has a profound impact on how we live our …

The behaviour of prices after periods of high inflation can vary, but generally, prices of goods and services do not decrease significantly, …

Budgeting is often viewed as a mundane task, associated with restrictions and sacrifices, but you can achieve financial success through budgeting.

Addressing under-earning requires a multifaceted approach encompassing both practical steps and shifts in mindset. Here are our Top Tips for Overcoming Under …

Financial anxiety is a common issue that can significantly impact your mental and physical well-being. Fortunately, there are strategies on managing anxiety …

A good credit score is crucial for accessing financial products such as loans, mortgages, and credit cards at favourable terms. How can …

Struggling with credit card debt can be overwhelming, but there are strategies you can employ to pay it off faster and regain …

Planning for retirement is crucial to ensuring financial stability and a comfortable lifestyle during your golden years. In this article we answer …

Managing the Cost of Living is the No. 1 concern for millions of Australians in 2024. In this article we look at …

Impulse spending can wreak havoc on your finances, leading to unnecessary debt and financial stress. Understanding and Avoiding Impulse Spending helps to …

Mortgage rates are a pivotal factor in the housing market and personal finance, acting as a significant influence on homeowners’ financial stability …

Navigating Financial Stress in Relationships is a sensitive topic, as money is often cited as one of the top sources of stress …